File Form TP-584 (Combined Real Estate Transfer Tax Return) with the appropriate county clerk (TAX Law 31-D-1449-EE(2)(d)). In New York, the real estate transfer tax is due at the time of recording. Contact the county clerk's office to verify requirements. This cover page is available on the local county clerk's website, and it factors into the total page count when calculating recording fees.

Most counties in New York require a recording page to accompany all documents for recording. Contact the same office to confirm accepted forms of payment. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Sign the deed in the presence of a notary public or other authorized official. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Law Sections 6-2.1, 6-2.2).Īs with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel, including the section, block, lot, and unit numbers. In the case of married persons, a tenancy by entirety is presumed, unless a joint tenancy or tenancy in common is expressly declared (E.P.T. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is expressly declared. Generally, real property is owned in either sole ownership or in co-ownership.įor New York residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. Vesting describes how the grantee holds title to the property.

Blank quit claim deed form full#

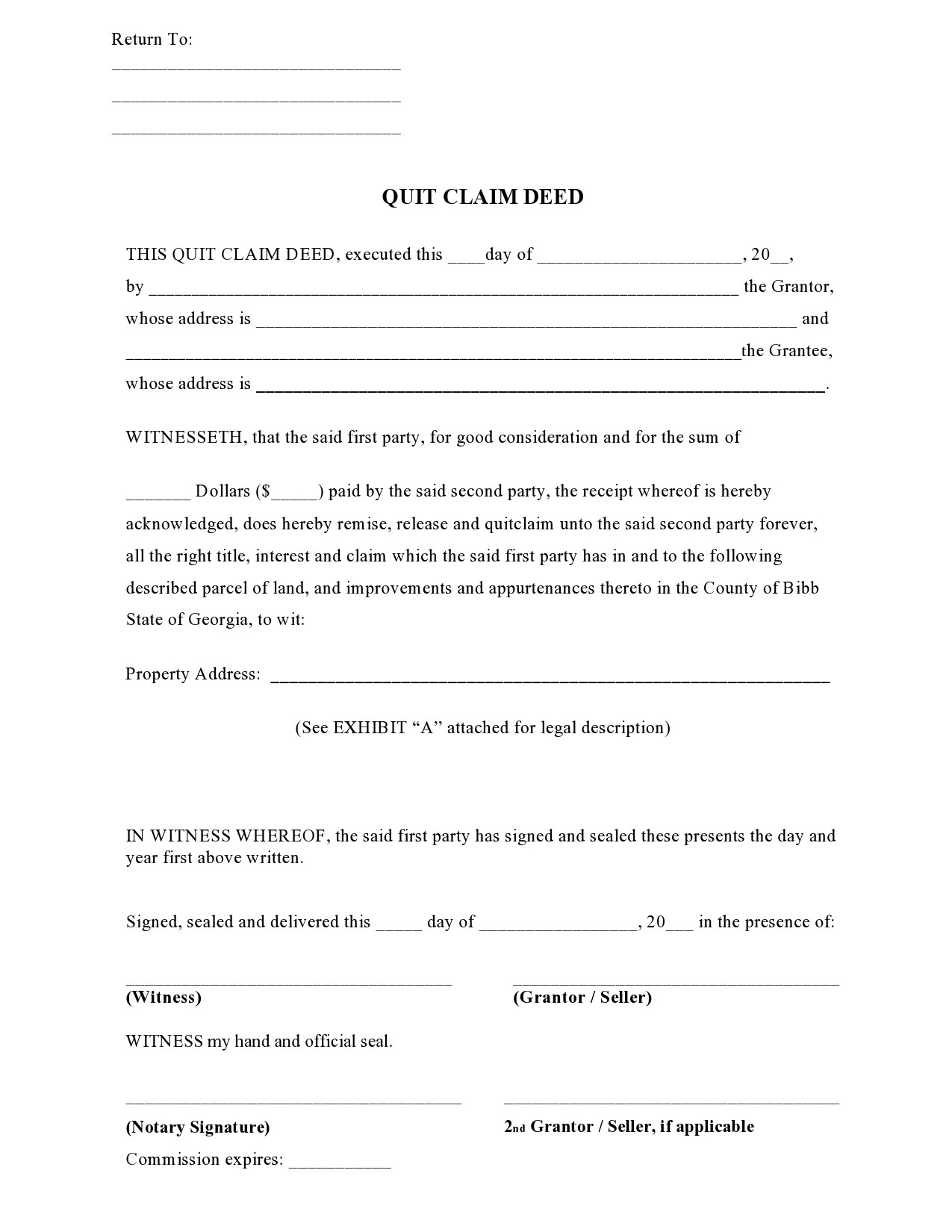

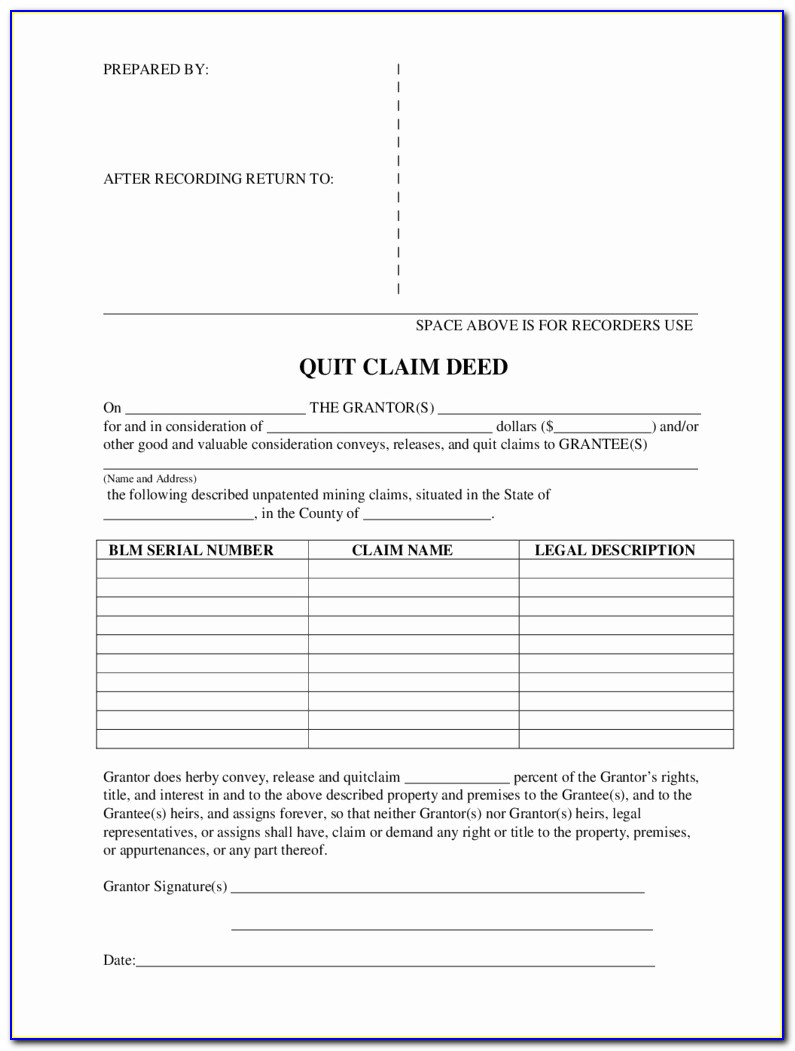

Bargain and sale deeds without covenant against grantor do not guarantee that the property conveyed is without encumbrances made by the grantor, but they do imply that the grantor held or holds an interest in the property being conveyed.Ī lawful quitclaim deed must meet all state and local standards for recorded documents, including the grantor's full name, mailing address, and marital status the consideration given for the transfer and the grantee's full name, mailing address, marital status, and vesting.

Quitclaim deeds offer less assurance than bargain and sale deeds, which convey whatever interest the grantor holds at the time of execution, sometimes with the promise that the grantor "has not done or suffered anything whereby the said premises have been incumbered in any way whatever" (NY Real Prop. They are generally reserved for divorces and other transfers of property between family members. They do not guarantee that the grantor has good title or ownership of the property and only transfer whatever interest the grantor may have in the property at the time of execution. Quitclaim deeds offer no warranties of title and provide the least amount of protection to the grantee. Quitclaim deeds are statutory under NY Real Prop. In New York, interest to real property can be transferred from one party to another by executing a quitclaim deed. Quit Claim Deed for Real Estate Located in New York

0 kommentar(er)

0 kommentar(er)